The US labor market is a riddle wrapped in a mystery inside an enigma. As everyone glanced at the headline numbers inside the latest jobs report, others took a deeper dive into the figures. The trends were quite concerning, from the collapse of full-time employment to the size and frequency of monthly revisions. But another facet largely ignored by many bureaucrats, economists, and politicians could prove to be a policymaking blunder. Job creation for foreign-born workers has outpaced native-born US employees over the last few years.

Taking Away American Jobs?

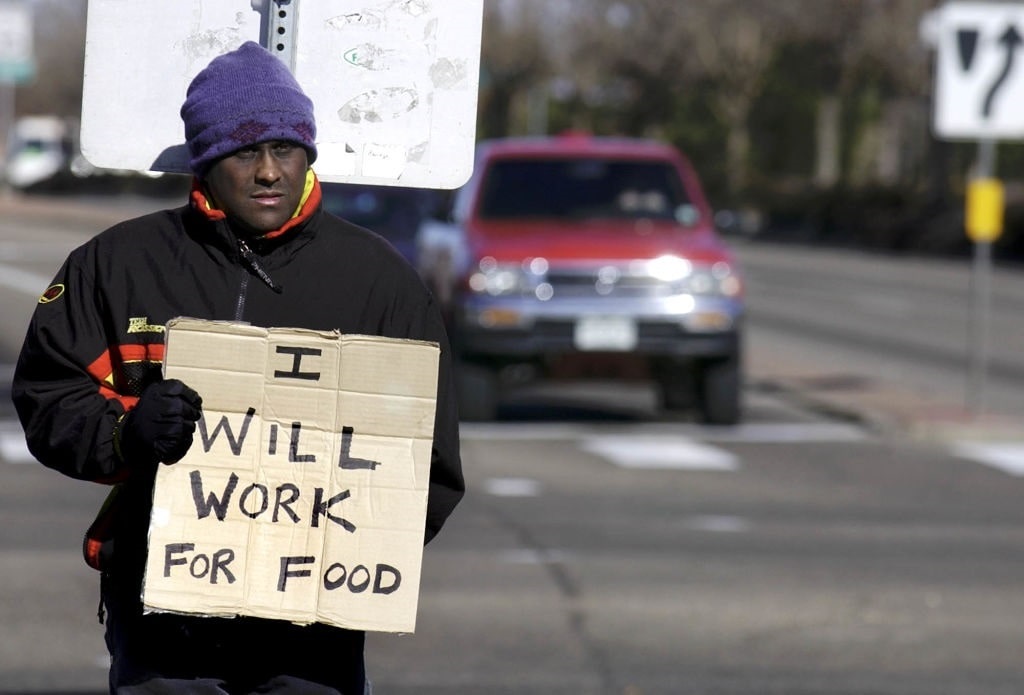

(Photo by Mario Tama/Getty Images)

Statists typically ask: Who will build the roads if not for the government? Leftists will likewise ponder: Who will pick produce if not for immigrants? For months, this has been the standard diatribe from Democrats, espousing that the border crisis is justified because who else will pick fruits and vegetables? “We need immigrants in this country,” said Rep. Jerry Nadler (D-NY) on Jan. 12. “Forget the fact that our vegetables would rot in the ground if they weren’t being picked by many immigrants — many illegal immigrants.”

Is this a sound argument for maintaining the chaos at the US-Mexico crossing? Economists can debate this, but one trend cannot be dismissed: the divergence in employment volumes between native- and foreign-born workers.

According to Bureau of Labor Statistics (BLS) data, native-born US workers have lost 1.44 million jobs since October 2019. By comparison, foreign-born workers have gained 3.524 million positions. This is a massive separation between the two demographics. The numbers show that the former has ebbed and flowed, but the latter has enjoyed a meteoric surge since the coronavirus pandemic.

Others have noticed this as well, including Zero Hedge, which recently asked on X: “How is this not the biggest political talking point right now?” Indeed, the punditry class can debate the fallout if this jobs trend persists. But the data suggest this canyon-sized gap will not close anytime soon.

War on Overdraft Fees

Over the last couple of years, President Joe Biden has tackled some of the most pressing issues facing the current generation, such as eliminating Taylor Swift concert ticket fees. But the White House is targeting another critical matter: overdraft fees.

(Photo By Natalie Kolb/MediaNews Group/Reading Eagle via Getty Images)

The Consumer Financial Protection Bureau (CFPB) unveiled a proposal to change banks’ overdraft protection plans. The independent watchdog agency will extend financial institutions two options for how to provide commercial overdraft coverage. The first will be to provide overdraft funds for profit if lenders classify the money as credit line loans. The second is allowing banks to offer clients overdraft products as a courtesy service, meaning the fees are “in line with their costs or in accordance with an established benchmark.”

CFPB officials also presented several possible benchmark rates, ranging from $3 to $14 per transaction.

Since 2000, US consumers have doled out about $280 billion in bank overdraft fees, the CFPB noted, and apparently the president noticed. In a Jan. 17 statement, Biden exclaimed: “For too long, some banks have charged exorbitant overdraft fees — sometimes $30 or more — that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines. Banks call it a service — I call it exploitation.”

Unfortunately, like all other government interventions, this will trigger unintended consequences, particularly for stressed borrowers. The primary ramification is that the administration will reduce access to short-term liquidity services, which consumers frequently use in today’s inflationary environment. Remember, administration officials even warned in December 2021 that “limiting overdrafts may limit the financial capacity for those who need it most.”

Additionally, this is also about consumer choice because clients can either opt in for overdraft services or cancel this coverage at any time. Nobody is forcing customers to utilize this feature. By tapping into this plan, they are conveying to banks that they would rather pay a charge than have a payment declined.

The Fed Balance Sheet

The Federal Reserve’s balance sheet – comprised of US government bonds and mortgage-backed securities – has exploded in the last four years, reaching close to $9 trillion. Since the central bank launched its quantitative tightening campaign in March 2022, the Eccles Building has trimmed it by approximately $1.4 trillion. It is unclear if the Fed will ever return to pre-crisis levels of around $4 trillion as monetary authorities have been coy about their runoff target.

Appearing virtually before the Brookings Institution on Jan. 16, Fed Governor Christopher Waller argued that policymakers could consider slowing down the Federal Open Market Committee’s tapering efforts later this year. Moreover, Dallas Fed Bank President Lorie Logan recently asserted that adopting a slower approach to reducing its holdings could allow officials to maintain its runoff initiative for a longer span.

Wait until the Federal Reserve needs to pivot entirely and begin to buy Treasury securities because fewer investors are scooping up bonds that have been issued at a massive scale!