Bears feasted on bulls for breakfast, lunch, and dinner in January. While Old Man Winter blanketed half the United States with snow and frigid temperatures, he also pummeled the New York Stock Exchange with red ink. Winter came for nearly all financial assets. The blood-soaked month was the worst since March 2020, with the leading benchmark stock market indexes recording notable losses and erasing some of the monumental gains enjoyed over the last couple of years. So, what was the cause of this intense selloff, and will it persist throughout 2022? Brace yourselves, a sharp drop might be coming.

Markets Get the Jimmy Legs

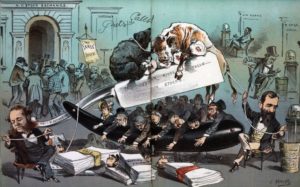

(Photo by: Photo12/Universal Images Group via Getty Images)

The January numbers were not for the faint of heart. Please, if you are a scream queen from the old Universal Studios horror movies, you may want to shut your eyes and wait until hero David Manners comes to your rescue. Here is a look at how the Big Three performed last month: The Dow Jones Industrial Average shed 4%, the S&P 500 lost more than 5%, and the Nasdaq Composite Index fell 9%. Be it growth or value stocks, it was challenging to seek shelter from the rainfall unless you owned most commodities and Treasurys. Yes, even cryptocurrencies and precious metals were losers, too.

Last summer, instead of trying to understand the coming market bloodbath, Liberty Nation recommended traders feel it. However, now it is clear what triggered the running of the bears on The Street to kick off 2022: The Federal Reserve System and the institution’s popular dance move, the Powell Pivot, which rivals the Macarena and Gangnam Style.

The Powell Putsch Stops

Financial markets have been bracing for the U.S. central bank to embark upon quantitative tightening by curtailing asset acquisitions, raising interest rates, and shrinking the more than $8 trillion balance sheet. The cause of this shift in attitude is rampant price inflation, with the consumer price index (CPI) soaring to its highest level in nearly four decades. And, of course, do not forget about the personal consumption expenditure (PCE) price index and the producer price index (PPI).

After two years of aggressive easing, the equities arena’s addiction to cheap money will need to be curbed because it will likely be forced to go cold turkey in 2022 and beyond. This expectation is what initiated investors’ – institutional and retail – rush to the exit door. With injections of liquidity, leading to a tsunami of inexpensive margin for traders, investment funds could pour into Tesla, and armchair investors could speculate on meme stocks, from AMC to Gamestop. The days of wine and roses for the mother of all bubbles (MOABs) are ostensibly over – for now.

Does this mean the selloff is over? It depends on whom you ask and what metrics you monitor.

In recent weeks, redemptions for passive exchange-traded funds (ETFs) have been rising, with outflows swelling in the U.S. stock market. Retail outflow volumes have been surging, and this market segment is refraining from taking short bets or buying the dips. The net margin balance remains at an all-time high, preventing traders from buying the dip. Plus, negative institutional sentiment is the lowest it has been in a decade (minus the financial crisis in February-March 2020). The CBOE Volatility Index, or VIX, which is the market’s fear gauge, has climbed 37% this year.

“Good news is that some Federal Reserve (Fed) officials are finally out trying to soothe investors’ nerves saying that they still want to avoid unnecessarily disrupting the U.S. economy,” said Ipek Ozkardeskaya, a senior analyst at Swissquote bank, in a note. “What will really make the difference is the Quantitative Tightening and given the steep rise in Fed’s balance sheet since March 2020, even halting the growth would be an abrupt change for the market conditions.”

“Good news is that some Federal Reserve (Fed) officials are finally out trying to soothe investors’ nerves saying that they still want to avoid unnecessarily disrupting the U.S. economy,” said Ipek Ozkardeskaya, a senior analyst at Swissquote bank, in a note. “What will really make the difference is the Quantitative Tightening and given the steep rise in Fed’s balance sheet since March 2020, even halting the growth would be an abrupt change for the market conditions.”

But when corporate earnings are abysmal aside from Apple and Microsoft, and forward guidance is dreadful, it can be difficult to be optimistic in this environment. With stagflation and even recession fears intensifying on Wall Street, it will prove to be nearly impossible to repeat the meteoric gains from the last two years. If Fed Chair Jerome Powell has pivoted before, he might pivot again, mainly if a meltdown produces a contagion event and sends the economy spiraling downward.

A Broken Tricycle

Since the U.S. stock market reached its bottom on March 23, 2020, it was clear that the tremendous rally was driven by two things: light on the other side of the pandemic tunnel and one-third of all U.S. dollars ever created in the nation’s history. Now that the Omicron variant could impact growth, and the Eccles Building is shutting off the taps, the market is hanging on by a thread, relying on a handful of companies to reverse the correction, whether it is Tesla or Amazon. But a broken tricycle that endured a myriad of pre-pandemic problems cannot stay intact in a rising-rate atmosphere. So, if winter is truly here for the stock market, the bears will stay warm in shorts while the bulls seek shelter in bonds.

~ Read more from Andrew Moran.