By now, you are aware of the pish-posh history of “inflation is transitory.” The current administration and the Federal Reserve insisted that the trillions of dollars in fiscal and monetary stimulus and relief would not trigger a bout of inflation. Then, policymakers conceded that any increase in the consumer price index (CPI) would be minor and temporary. Once the inflationary metrics began soaring each month, they argued it would soon pass. It can essentially be described as Washington’s stages of inflation grief. Nearly three years later, the most odious tax is entrenched and has overstayed its welcome. However, some economists still think all of this is transitory. As the famous movie quote-turned-meme goes, “You keep using that word. I do not think it means what you think it means.”

Transitory Poppycock

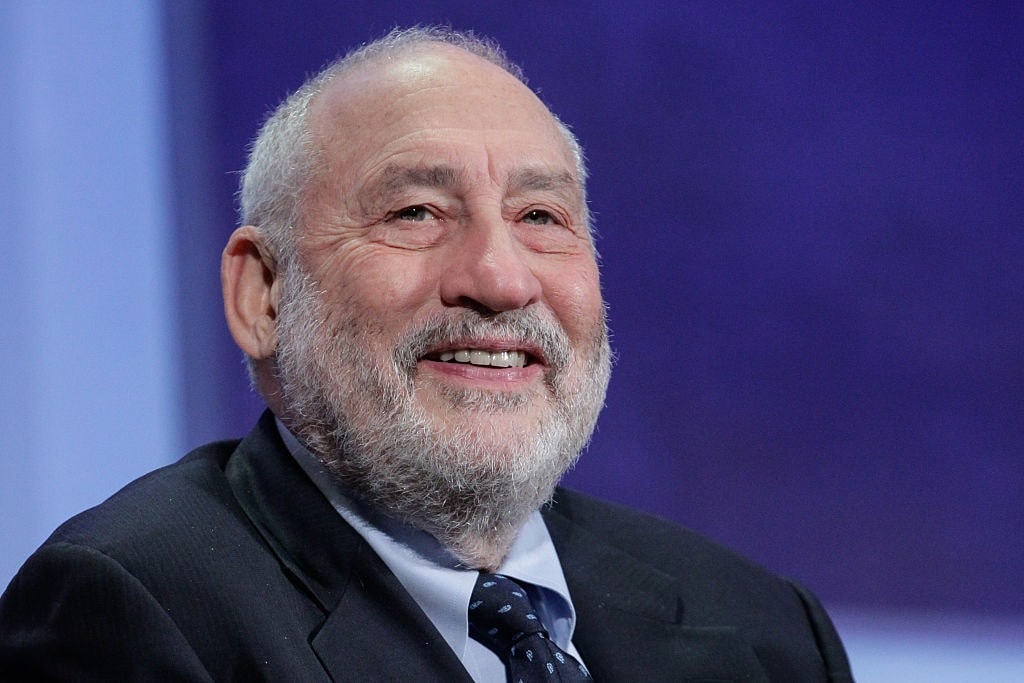

Nobel Prize-winning economist Joseph Stiglitz recently published an opinion piece on MarketWatch entitled “Turns out that inflation really was transitory, no thanks to the Fed.” He opined that he and many of his colleagues predicted there would be disinflation or deflation following the spike (hello, base effect!), writing: “We were right.” He added in what can only be described as shifting the goalposts:

“Inflation has indeed fallen dramatically in the United States and Europe. Even if it has not reached central bankers’ 2% target, it is lower than most expected (3.7% in the U.S., 2.9% in the eurozone, 3% in Germany and 3.5% in Spain). Moreover, one must remember that the 2% target was pulled out of thin air. There is no evidence that countries with 2% inflation do better than those with 3% inflation; what matters is that inflation is under control. That is clearly the case today.”

Joseph Stiglitz (Photo by JP Yim/Getty Images)

His reasoning? Car and energy prices have stabilized. This is comparable to fellow Keynesian economist Paul Krugman, who recently posted on X that if you remove food, energy, shelter, and used vehicles from measurements, “the war on inflation is over. We won, at very little cost.” However, months earlier, Krugman admitted he was wrong on his inflation forecasting, including the transitory poppycock.

Stiglitz’s additional observations ostensibly put the kibosh on the idea that creating trillions out of thin air had nothing to do with the CPI hitting a 40-year-high. At the same time, give credit where credit is due: Stiglitz was accurate in his supposition that the entire 2% target rate is a random figure with no reasonable justification from the Eccles Building. This was displayed at a recent Senate hearing where Fed Chair Jerome Powell could not answer why 2% is the official objective.

That said, Stiglitz is not the only one to purport that inflation is transitory. Minneapolis Fed Bank President Neel Kashkari asserted this same belief this past summer. But are these accurate positions? The joy of macroeconomics is that anyone can craft a chosen narrative once he or she dives deeper into the treasure trove of official data.

Inflation of the Lambs

Let’s be honest: The Bureau of Labor Statistics’ CPI is a joke for many reasons, from the weights to what is not included in the monthly report. Health insurance is an excellent example of why it should not be taken too seriously. According to the October CPI data, health insurance costs plummeted 34% over the last year and accounted for 52.5 cents out of every $100 spent. While tracking can be difficult, finding anyone who has experienced lower health insurance costs in the past 12 months would be a herculean feat.

Aside from the method calculation, it is worth pointing out that inflation continues to climb, though at a slower pace (disinflation). So, since 2021, cumulative inflation has been around 18%. This includes a 21% increase in food, an 18% jump in rent, and a 25% spike in electricity. These things matter to everyday Americans, not junk fees for Taylor Swift concerts. Indeed, prices will not be returning to their pre-crisis levels, meaning that a $100 grocery bill will not go to $80. Instead, it will rise to $102, $105, and so on. This is in addition to a devalued currency requiring more units to purchase the same amount of goods and services.

So, what is the best way to measure price inflation? The Federal Reserve’s money supply, or the true money supply (TMS) produced by eminent economists Murray Rothbard and Joseph Salerno. Because inflation is the expansion of the money supply, which has ballooned 34% since the pandemic’s beginning, the result is price inflation. Based on Fed data, there is a direct correlation between the money supply and the CPI. If the economy slips into a deep recession next year, the central bank will inevitably fire off the printing presses again, producing a stagflation climate. How long must inflation be above-trend so that the transitory talk is incinerated and the ashes tossed into the dustbins of history?