In the aftermath of the last economic collapse, politicians and bureaucrats peddled easy money that quickly turned the US population into addicts, justifying this process as a way to resuscitate the economy and generate growth. Spend, spend, spend – and a little bit more spending – enabled the government’s appetite for waste and the consumer’s bad habit of debt-binging. With interest rates at historic lows, bringing down borrowing costs, the smartest folks in the room opened a Pandora’s box and enabled Americans and the rest of the world to get their next fix by inserting, swiping, and tapping.

Will consumers go cold turkey, or will they overdose on debt?

Wipeout

According to a new study by Bloomberg, the US economy would collapse if Americans ended their addiction to debt and the Federal Reserve exhausted its currency and gold reserves. The US has been consistently ranked as the biggest and best economy in the world today, but it would not even be in the top 100 economies by gross domestic product (GDP) per capita. That is a sad revelation.

The business news network arrived at this conclusion by utilizing different variables to construct a borrowing-free world. Bloomberg started this crusade by using the International Monetary Fund’s GDP projections for 2020. It then modified the figure by eliminating the ability to borrow and adding reserves to produce an alternative wealth measure.

US per capita income, just under $67,000, would crater to negative $4,857. This represents a $72,000 loss. That is nothing to sneeze at. But Americans can take solace in the fact that they are not alone in this pecuniary epidemic.

Of the 114 economies on the list, 102 would see a decline in per capita wealth. The country that ranked at the bottom of the barrel was Japan. The world’s third-largest economy would experience $93,000 of income per person wiped out, tumbling to a negative $50,000.

China, on the other hand, would benefit in such a universe, mainly because of its $3.36 trillion in gold and currency reserves. This would not be permanent, however. As reported by The Wall Street Journal, a general shift happening in Beijing finds young people no longer saving and instead choosing to spend freely to satisfy every desire. So, eventually, the Chinese will become debt addicts, too.

Although this report should serve as a wake-up call to every American, it is unlikely that a debt-free world will come to fruition anytime soon. This is especially true in the United States.

In spite of trade wars, trillion-dollar budget deficits, ballooning debts, and Washington running around like a chicken with its head cut off, there remains a hunger for US debt. Put simply, investors are feeding the beast instead of allowing the country to go cold turkey. They are giving the nation its next fix.

In Debt We Trust

Consumers repeatedly spend more than what the market anticipates every month. While socking away money for a rainy day is stronger than it was prior to the recession, the personal savings rate still falls short of the 17% average in 1975. The consumer debt total is a whopping $13 trillion, and debt service payments as a percentage of disposable personal income are 10%. Many have sounded the alarm about derelictions, but with interest rates still at all-time lows, the delinquency rate on all loans is just 2%; the range before the crash was 3.5% to 5%.

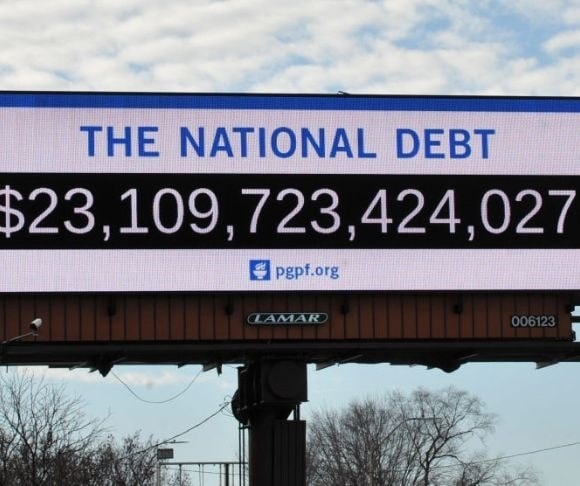

The federal government is not faring much better. Washington will post a $1 trillion budget deficit, Congress recorded a double-digit increase in outlays in July, the national debt will soon top $23 trillion, and the Treasury is borrowing record amounts just to survive. Should we even mention the $200 trillion in liabilities waiting around the corner? The public purse will only worsen when the next recession hits because the government will spring into action and launch what always turns out to be a failed stimulus program.

These are not sturdy pillars of affluence.

So, who is to blame for this mess? Sure, voters are culpable for electing irresponsible government officials, and consumers are at fault for taking on too much debt. That said, consider this situation: A fourth-grade teacher gives each student a bucket of candy and a can of soda. She leaves the classroom and the kids go wild, throwing around desks, pencils, and textbooks. Now, many would be perturbed by the raucous behavior of nine-year-olds. But who bears responsibility? The kids or the teacher who supplied an overdose of sugar?

That is similar to what is happening in the US and the rest of the world.

The Federal Reserve and other central banks have supplied markets with cheap money through artificially low interest rates. This monetary policy maneuver gave us the illusion of wealth and the idea that we can have it all without sacrificing anything. It is a classic Mephistophelean tale – instant gain for long-term pain.

Sooner or later, however, the powerbrokers in hell come for you in the form of uncouth collections calls and stern letters.

Can I Borrow a Feelin’?

Yes, two-thirds of the $19.4 trillion US economy is driven by the consumer. This is unsustainable.

An economy does not thrive on spending. An economy is founded and maintained through savings and investments, and then goods and services are purchased from the cash saved in your sock drawer or inside a copy of your Paul Krugman book.

With all the reports denouncing borrowing, this instrument must be evil, right? Not necessarily. It is a tool like any other.

The purpose of borrowing is to buy time. The typical house in America costs about $300,000, plus all the taxes and fees that come with acquiring your fortress of solitude. For the average family, it requires many years of saving to buy the home of their dreams, which would become more expensive as they collected the money. By applying for a mortgage, you borrow from a lender for the next 30 years to save you time.

This same principle applies to a host of other goods, such as a university education to build your human capital and an automobile to drive from point A to point B.

We get into dangerous territory when consumers treat borrowing as their personal ATM. When a credit card or a line of credit is used to put clothes on the table, food on over your head, a roof on your back, and treat the family to a fun vacation in Vladivostok, then the foundations of the economy begin to wobble.

There are many reasons consumers are drowning in debt: poor financial choices, a need for instant gratification, living beyond their means, a job loss, a failure to save for unforeseen circumstances, and the list goes on. Because this is no way to expand an economy perpetually, the pain of our abysmal decisions will be unveiled during the next crisis.

Writing in How an Economy Grows and Why It Crashes, Peter Schiff delivers this ominous warning: “If we choose to put our faith in debt, the printing press, and the promise of pain-free government solutions, we will all be fishing without a net.”

Wise words, Mr. Schiff.

Doom and Gloom

While the nation’s short-term prospects appear fine, the long-term health and future of the United States are not promising. Despite claims that economic fundamentals are sound, way too much evidence suggests the contrary, from the ballooning national debt, to trillions in unfunded liabilities and expenditures, to swelling household debt. The good times may be rolling in today, but tomorrow will be a different story. The chickens will come home to roost, the bills are in the mailbox, and the next kick of the can could ignite an atomic reaction. But who is going to save us?

~

Read more from Andrew Moran or comment on this article.