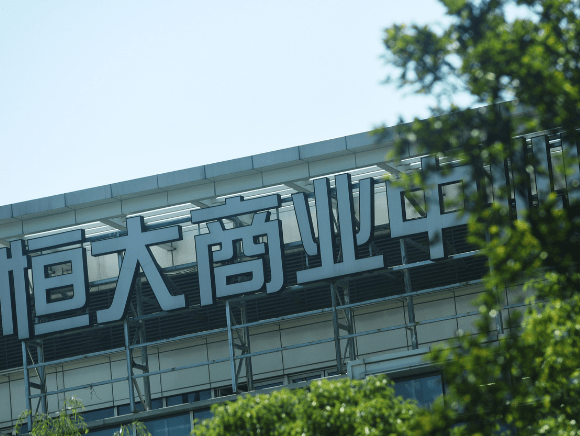

Evergrande Group, China’s second-largest property developer, has captured international headlines for the last two weeks. Aside from the Federal Reserve, Evergrande is perhaps the biggest and most consequential story in the global financial markets today as its pending demise could lead to a tsunami stretching from Beijing to London to New York City. The crisis unfolding at Evergrande is unfolding by the hour, with more revelations coming out, which has not boded well for the company’s stock after cratering 49% so far this month. So, let’s try to break down some of the key developments.

Evergrande is Grand No More?

There is a lot of activity occurring between major investment funds and Evergrande. While Credit Suisse dumped its exposure last year because of risk, and Chinese Estates may follow suit, others are pouring into the company. Fund managers, including UBS, BlackRock, and HSBC, have increased their Evergrande dollar bond holdings, signaling that the most indebted developer on the globe, with $300 billion in liabilities, is a buy.

According to The Wall Street Journal, an auditor gave the company a clean bill of health despite the swelling levels of debt. In its annual report, the auditor gave the organization a thumbs up as it was offering investors and consumers discounts to ensure sales were rising throughout the coronavirus pandemic. As it tried to sustain itself, Evergrande borrowed too much, but the auditor did not see anything wrong with the balance sheet. It looks like Evergrande might have missed its $83.5 million coupon payment. From CNBC to Bloomberg News, reports suggest that holders of U.S. dollar-denominated debt, worth $2.03 billion at face value, “gave no signs” that they were paid the interest owing.

According to The Wall Street Journal, an auditor gave the company a clean bill of health despite the swelling levels of debt. In its annual report, the auditor gave the organization a thumbs up as it was offering investors and consumers discounts to ensure sales were rising throughout the coronavirus pandemic. As it tried to sustain itself, Evergrande borrowed too much, but the auditor did not see anything wrong with the balance sheet. It looks like Evergrande might have missed its $83.5 million coupon payment. From CNBC to Bloomberg News, reports suggest that holders of U.S. dollar-denominated debt, worth $2.03 billion at face value, “gave no signs” that they were paid the interest owing.

In the end, will Beijing bailout Evergrande? The consensus in the international markets is that China will not come to Evergrande’s rescue. However, the government could implement measures to prevent a contagion event, including the recent $16 billion injection into the financial system and ensuring the company used its funds to put toward building properties instead of paying creditors.

The Tapering, Coming Soon

The Federal Reserve completed its two-day Federal Open Market Committee (FOMC) policy meeting on Sept. 22. The powwow’s conclusion left everyone in suspense and wanting more, much like a theatrical trailer for the next Bulldog Drummond feature. The central bank’s statement confirmed that interest rates would remain near zero and that the institution was monitoring events unfolding in the U.S. economy. However, what everybody wanted to hear about was the t-word: tapering.

Speaking to reporters after the event, Fed Chair Jerome Powell verified that an official announcement of tapering of its $120-billion-a-month quantitative easing (QE) would be coming “soon” – perhaps as early as the November FOMC get-together. It is estimated that the pandemic-era stimulus and relief efforts could be decreased to as low as $15 billion per month by spring 2022.

“While no decisions were made, participants generally viewed that so long as the recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate,” said Powell, whose term is winding down, in his post-meeting news conference.

One significant component of the monthly session was the revision downward for key economic measurements in 2021. For example, in June, the Fed forecast 7% growth for the gross domestic product (GDP). This time, it was adjusted to 5.9%. The unemployment rate was also changed upward, going from 4.5% in the June projection to 4.8% in the September meeting. The personal consumption expenditures (PCE) price index was increased from 3.4% to 4.2%. Whatever the case may be, if the Fed is removing the spiked punch bowl from the table, investors are not happy, possibly explaining the rush out the door.

Goodbye, Bulls?

Have the monumental gains in the stock market from the last 18 months been exhausted? Investors seem to think so as they take the money and run to their local banks and deposit cash in their accounts.

For the first time in 2021, there was net selling of equities in the week ending Sept. 22, according to new data from the Bank of America Global Investment Strategy. The figures show that net flows into international equity funds slipped into negative territory, transitioning from $45 billion to -$28.6 billion. This represented the largest outflow from U.S. stocks since February 2018. Investors were hitting the sell button across the board: energy (-$200 million), technology (-$1.2 billion), U.S. large-cap (-$14.2 billion), and retail (-$1 billion). So, where is the money going? Here is a breakdown of the allocations during this period:

- Cash: $39.6 billion

- Bonds: $10 billion

- Emerging Markets: $2.6 billion

- Japan: $500 million

- Gold: $84 million

Despite the rough week of trading, the Sept. 21 meltdown in the financial markets may not be an isolated incident. Indeed, there might be more volatility on the way, particularly if the Federal Reserve slows down the printing press and blood fills the asphalt jungle on The Street. So, is it time to take the 105% gains in meme stocks and transfer the profit into a low-rate savings account?

~ Read more from Andrew Moran.