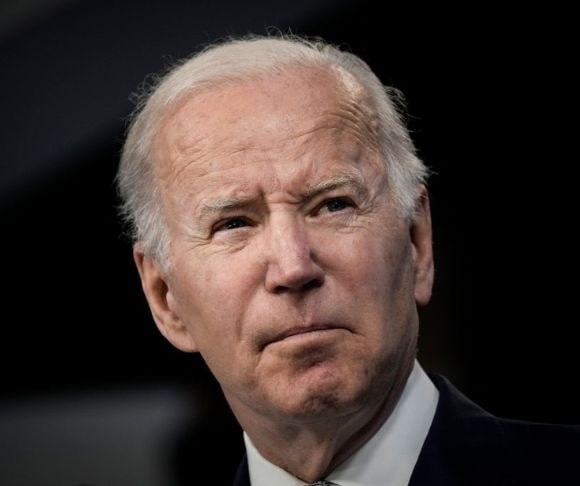

A recent Liberty Nation poll found that most believe $5 gas will be the most important issue for voters in the mid-term elections in November, topping abortion rights. If this is the attitude that Americans possess heading into the voting booth, it might not bode well for President Joe Biden and the Democrats, especially after the latest messaging calamity from the Commander-in-Chief.

Speaking to reporters at the conclusion of this week’s NATO summit in Madrid, Spain, Biden was asked how long Americans can expect to contend with soaring energy prices. His response did not spark confidence or encourage households still feeling the pain at the pump and financial agony in their utility bills.

[substack align=”right”]“As long as it takes. Russia cannot, in fact, defeat Ukraine and move beyond Ukraine,” the president responded. “This is a critical, critical position for the world. Here we are. Why do we have NATO? I told Putin that, in fact, if we were to move, we would move to strengthen NATO. We would move to strengthen NATO across the board.”

Biden also tried to kill two birds with one stone: blame President Vladimir Putin for the spike in price inflation and champion his economic record by claiming that inflation is higher in other countries. “I can understand why the American people are frustrated because of inflation. But inflation is higher in almost every other country,” he said.

One look at inflation rates around the world shows that this is incorrect. Today, the US annual inflation rate is 8.6%. Elsewhere, the flash European Union inflation reading is 8.6%, Canada is enduring a 7.7% consumer price index (CPI), Japan recorded a rate of 2.2% in May, and Australia posted a 5.1% CPI. So, what is he talking about exactly? Perhaps he is referring to Turkey’s 70% inflation and Venezuela’s 100% rate. At this point, Biden either speaks gibberish or utters falsehoods.

A Recession is Coming

While Wall Street and economists have increasingly made a recession their base case within the next 18 to 24 months, the US might already be situated in an economic downturn, according to the latest and perhaps most reliable gross domestic product (GDP) indicator.

The Federal Reserve Bank of Atlanta’s GDPNow model shows that the economy is projected to contract 1% in the second quarter. This is down from the previous growth estimate of 0.3%. But what caused the downward revision? New economic data. In the April-June period, real personal consumption expenditures growth tumbled to 1.7%, and real gross private domestic investment growth declined to -13.2%. Also, real net exports rose to a subdued 0.35%.

WASHINGTON, DC – JUNE 15: U.S. Federal Reserve Chairman Jerome Powell (Photo by Drew Angerer/Getty Images)

Meanwhile, separate economic data on July 1 should have Washington officials worried. The Institute for Supply Management’s manufacturing purchasing managers’ index (PMI) dropped to 53, falling short of the market estimate of 54.9. Construction spending fell 0.1%, personal spending edged up at a lower-than-expected pace of 0.2%, and initial jobless claims four-week average inched higher again to 231,750.

So, where is this strong economy that the administration is touting? Perhaps it is inside the “Liberal World Order” recently touted by National Economic Council (NEC) Director Brian Deese where data, facts, and numbers are manufactured out of thin air, and Biden is the God-Emperor of the United States.

Bears Devour Stocks in First Half

It was a bloodbath on the New York Stock Exchange in the first six months of 2022, with equities suffering their worst first half since 1970. The only bright spots in the market were agriculture, energy, and the US dollar. So, how bad was it in the stock market? Well, investors will need a mop and bucket to clean up all that red ink flowing on Wall Street and forcing traders to digest crates of Pepto Bismol. Here is a look at the percentage performances in this bear invasion:

- Dow Jones Industrial Average: -15.31%

- Nasdaq Composite Index: -29.51%

- S&P 500: -20.58%

- Gold: -1.36%

- Silver: -13.6%

- Copper: -17.29%

- Bitcoin: -59%

However, for investors parked in commodities, they were the only ones who might have been ebullient. Crude oil and natural gas soared 40.5% and 58%, respectively. Gasoline prices spiked 60.51%. Soybeans climbed 7.7%, corn rose 4.3%, and wheat advanced 15.35%. Also, the US Dollar Index (DXY), which gauges the greenback against a basket of currencies, soared more than 9% in the January-June span.

But why did this happen? It was all centered around inflation and how public policymakers responded. The Federal Reserve is turning ultra-hawkish, raising the benchmark Fed funds rate by 75 basis points in June. Businesses and consumers are responding negatively to this inflationary rising-rate environment as the PMIs, personal savings rate, and sentiment collapse. The second half may not fare any better as investors price in a recession and brace for a long dark winter. Better store your nuts!