Former President Ronald Reagan changed the political playbook forever when he coined the key election question: Are you better off now than you were four years ago? By the time the voting public casts a ballot in the next presidential campaign, the American people will have endured a few years of the Biden economy. Looking back to February 2021, it is challenging to find much in the way of positive outcomes from the current administration. Is it any surprise that a record number of Americans are pessimistic about the present economic landscape? This is an exceptional case study of Bidenomics.

Sour on the Biden Economy

The results of the latest CNBC All-America Economic Survey are out, and the data do not shine a positive light on the chief executive’s record. The poll found that 69% of the public maintains negative views about the Biden economy, an all-time high in the survey’s 17 years. It seems that Americans are getting fed up with rampant price inflation, high interest rates, and constant recession concerns.

The most notable revelations in the study:

- 67% of respondents said their wages are falling behind inflation.

- 66% expect the country to slip into a recession or may already be in a downturn.

- 54% of Americans reported that the rise in food prices impacted them the most.

- 51% of working-class Americans are working more to make ends meet.

- 24% think now is a good time to invest in stocks.

All of this is weighing on the president’s approval rating. The CNBC poll revealed that 62% disapprove of the way Biden is handling the economy, up from 57% in the previous survey. This was the second-worst reading of his term so far. Overall, his approval rating stood at 39%, down from 41% in November.

Pessimism Everywhere

It is not only this one survey that highlights immense pessimism about the Biden economy. A broad array of reports and metrics spotlight businesses and consumers losing patience in this environment both now and in the future.

The Federal Reserve Bank of New York’s Survey of Consumer Expectations displayed growing discontent among US households. Income growth expectations for the year ahead was 3.3%, the lowest since July of 2022, while nearly 11% expect to be unable to make minimum debt payments over the next three months. More than one-quarter of households say their financial situation will be worse off a year from now and about 41% acknowledged that they are worse than a year ago. Plus, half the country’s households think it will be harder to obtain credit a year from now and that it’s harder now than it was one year ago.

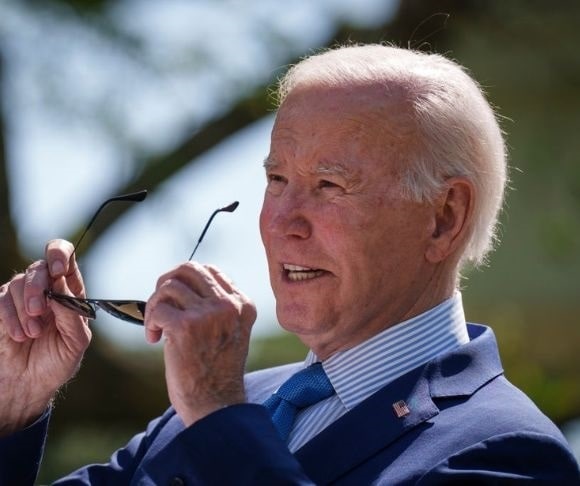

(Photo by I RYU/VCG via Getty Images)

These downbeat views of the economy make sense, considering that a recent CNBC Your Money Financial Confidence Survey discovered that 58% of Americans are living paycheck to paycheck and about 70% are financially stressed. Or a Lending Club survey reporting that 9.3 million more Americans finished 2022 living paycheck to paycheck.

But it is not only consumers getting frustrated over these conditions. The National Federation of Independent Business’ Small Business Optimism Index fell to a three-month low of 90.1 in March, marking the 15th consecutive month of the index hovering below the 49-year average of 98. Comparable with consumers, market conditions are not exactly impeccable for entrepreneurs in most sectors.

In the aftermath of the banking turmoil last month, studies have revealed tighter credit conditions – the lifeblood for the private sector. The Conference Board’s Leading Economic Index, a chief recession indicator, tumbled again by 1.2%. Industrial and manufacturing production levels have weakened. Retail sales tanked 1% last month.

Even the labor market, which had been the lone bright spot for the White House – if you remove the fact that real wage growth and weekly earnings (inflation-adjusted) have been negative for 92% of Biden’s presidency – is showing signs of slowing down. The most recent measurement, initial jobless claims, surged to 245,000 for the week ending April 15, up from 240,000 in the previous week. Continuing jobless claims shot up to 1.865 million, up from 1.804 million.

Despite recent bullish remarks from St. Louis Fed Bank President James Bullard, the US central bank has ostensibly turned bearish. In addition to Fed economists forecasting a “mild recession” later this year, the Eccles Building’s monthly Beige Book offered a bleak assessment of the economy, emphasizing that “lending volumes and loan demand generally declined across consumer and business loan types,” and “banks tightened lending standards amid increased uncertainty and concerns about liquidity.”

Despite recent bullish remarks from St. Louis Fed Bank President James Bullard, the US central bank has ostensibly turned bearish. In addition to Fed economists forecasting a “mild recession” later this year, the Eccles Building’s monthly Beige Book offered a bleak assessment of the economy, emphasizing that “lending volumes and loan demand generally declined across consumer and business loan types,” and “banks tightened lending standards amid increased uncertainty and concerns about liquidity.”

Can Republicans Win the Big One?

The November midterm elections should have been an emphatic defeat for President Biden and the Democrats. The political pundits can debate the reason why the GOP narrowly secured a House majority rather than riding a so-called red wave. Since obtaining the trifecta of power, the Democrats have overseen 40-year high inflation, a plethora of different shortages, soaring food and energy prices, a bear market, rising borrowing costs, eight million people working two or more jobs, a banking crisis, and the list goes on. Will this be enough to oust Biden and allow Republicans to take control of the Senate – and grow their House majority? It might if the Republican presidential nominee asks the famous question: Are you better off now than you were four years ago?